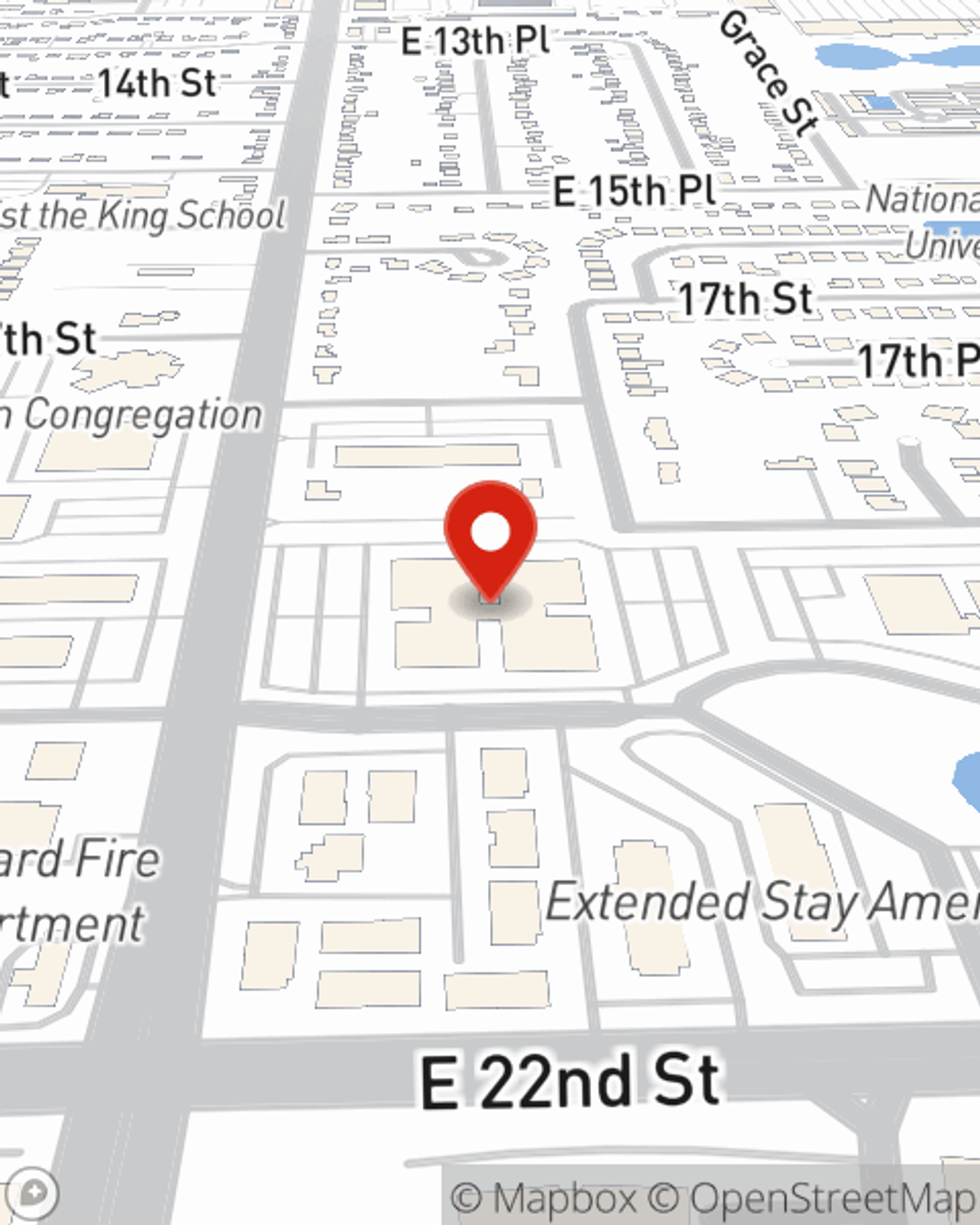

Life Insurance in and around Lombard

Get insured for what matters to you

What are you waiting for?

Would you like to create a personalized life quote?

- Lombard

- DuPage County

- West Suburbs

- Oak Brook

- Downers Grove

- Naperville

- Bolingbrook

- Glen Ellyn

- Wheaton

- Chicago Land Area

It's Never Too Soon For Life Insurance

People choose life insurance for several different reasons, but the ultimate goal is almost always the same: to secure the financial future for your loved ones after you perish.

Get insured for what matters to you

What are you waiting for?

Life Insurance Options To Fit Your Needs

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Thomas Revish, Jr. is committed to helping process the death benefit with care and consideration. State Farm has you and your loved ones covered.

To experience your Life insurance options with State Farm, contact Thomas Revish, Jr.'s office today!

Have More Questions About Life Insurance?

Call Thomas at (630) 620-7373 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.

Thomas Revish, Jr.

State Farm® Insurance AgentSimple Insights®

How much life insurance do I need?

How much life insurance do I need?

Here are some of the main factors to consider when you start thinking about the people & assets you want to protect & how long you want to protect them.

Dip your toes in the water with our swimming and water safety tips

Dip your toes in the water with our swimming and water safety tips

Swimming is a fun activity the whole family can enjoy. It also comes with risk and water safety should always be top of mind for you & your family.