Condo Insurance in and around Lombard

Condo unitowners of Lombard, State Farm has you covered.

Quality coverage for your condo and belongings inside

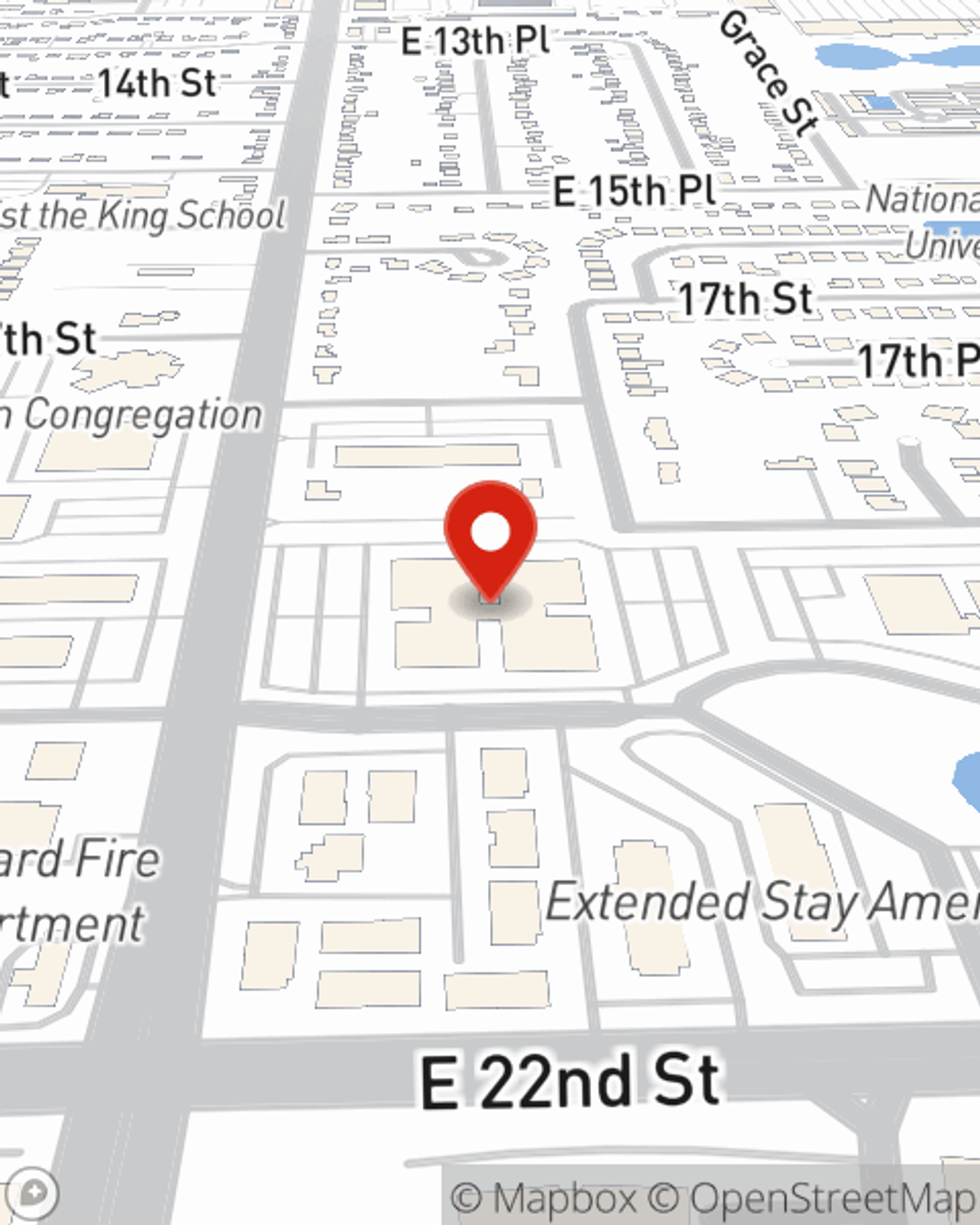

- Lombard

- DuPage County

- West Suburbs

- Oak Brook

- Downers Grove

- Naperville

- Bolingbrook

- Glen Ellyn

- Wheaton

- Chicago Land Area

Welcome Home, Condo Owners

When it's time to kick back, the home that comes to mind for you and your family and friendsis your condo.

Condo unitowners of Lombard, State Farm has you covered.

Quality coverage for your condo and belongings inside

Agent Thomas Revish, Jr., At Your Service

There's truly no place like home. You need condo unitowners coverage to keep it safe! You’ll get that with Condominium Unitowners Insurance from State Farm, a trusted name for condo unitowners insurance. Thomas Revish, Jr. is your reliable State Farm Agent who can present coverage options to see which one fits your unique needs. Thomas Revish, Jr. can walk you through the whole coverage process, step by step. You can have a no-nonsense experience to get coverage options for everything that's meaningful to you. We’re talking about more than just protection for your electronics, linens and home gadgets. You'll want to protect your family keepsakes—like mementos and souvenirs. And don't forget about all you've collected for your hobbies and interests—like cameras and sports equipment. Agent Thomas Revish, Jr. can also let you know about State Farm’s great savings and coverage options. There are savings if you carry multiple lines of State Farm insurance or have home security devices, and there are plenty of different coverage options, such as additional business property and even personal articles policy.

Ready to move forward? Agent Thomas Revish, Jr. is also ready to help you see what customizable condo insurance options work well for you. Call or email today!

Have More Questions About Condo Unitowners Insurance?

Call Thomas at (630) 620-7373 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Thomas Revish, Jr.

State Farm® Insurance AgentSimple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.